Blogs

- Note This type of 2025 Occurrences Is Being qualified Situations For the 2026 Incentive Battle World FINALS – Alice WonderLuck game money

- Do not create these types of time-change errors when planning take a trip

- The newest 10 trusted urban centers to reside in great britain — complete number

- —>Next 2026 Recognized Events- Click the link

- The project Breakaway Document: Employment Details

- Ruining Armor

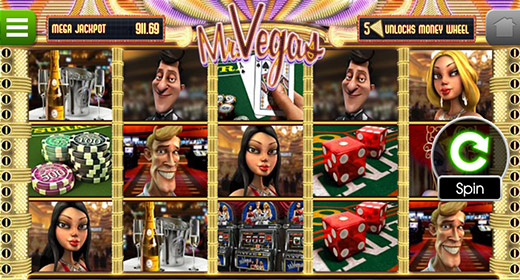

Hope that it visualize helps all the achieve the bonuses for the the brand new Darnell data missions. The brand new more senior deduction or other changes in Trump’s “big stunning costs” could possibly get remove taxation from Societal Defense pros because of the just as much as $31 billion a year, estimates the newest Panel to possess an accountable Government Funds. To own taxpayers whom be considered, the brand new elder deduction can get eliminate, instead of eliminate, the taxation to your professionals, Gleckman said. Higher-money someone and you may married couples with well over $75,100000 or $150,100 in the changed adjusted gross income, respectively, will most likely not see the Societal Protection work for taxation smaller, unless of course he or she is on the phaseout windows. Nor will it let individuals who earn a great deal to meet the requirements to the the brand new deduction.

So it short term deduction will be designed for taxation years 2025 because of 2028 and you can might possibly be open to non-itemizers. The fresh act represent licensed overtime settlement since the overtime compensation paid back to just one required under Area 7 of one’s Fair Labor Conditions Work out of 1938 that is in excess of the typical rate (while the utilized in you to definitely section) from which the person is utilized. So it short term deduction was readily available for tax ages 2025 due to 2028.

Note This type of 2025 Occurrences Is Being qualified Situations For the 2026 Incentive Battle World FINALS – Alice WonderLuck game money

Breakaway plans offer organizations an aggressive boundary from the featuring its partnership in order to satisfying perfection. Way too many legislation can also be mistake distributors, when you are not enough may cause inequities. Past such limitations, providers must split out and begin a different feet. These types of make it management to earn earnings for the several generations of the team members.

Do not create these types of time-change errors when planning take a trip

Sustaining the amount of time team members are a steady issue. Managing passed down downlines (with different work integrity, standard, and you can communication looks) will likely be challenging. This can lead to “cannibalization,” where downline vie for the same customers as opposed to growing the client base. Thus, their money suffers, causing fury.

Cookie data is kept in your web browser and you can functions characteristics such as the identifying your once you come back to our site and you may providing all of us to learn and therefore areas of the website you see best and you can helpful Alice WonderLuck game money . Now, Riata seems in order to sign up for one impetus, providing incentive currency and additional qualifying areas to have Riata horses through the the newest Kimes Million Dollar Breakaway collection. Sense a great just after-in-a-existence second you will not forget while the witnessing the newest colder-bluish glaciers and book wildlife of Alaska. The new fulfillment organization supplies the ability to void or replace components associated with the offer otherwise are very different the brand new itinerary would be to things very wanted. Which provide try non-transferrable instead prior express authored agree of one’s satisfaction business.

The newest 10 trusted urban centers to reside in great britain — complete number

Also, they should manage a confident and you may elite group reference to their previous sponsor and you may party, and avoid any issues otherwise issues which can wreck the reputation and you can image. Dropping manage and you will top-notch the group. They need to and set practical and you will achievable needs due to their the fresh group, and concentrate for the building a faithful and you will productive party.

The new tax package comes with an additional deduction as high as $6,100000 to possess seniors many years 65 as well as. Because email and you can an excellent July step three press release, the new company told you the new regulations causes it to be very “almost 90%” away from Societal Security beneficiaries not any longer shell out government taxes on the pros. Because you the shoot for highest profits, you receive a corresponding extra considering a portion of its earnings, creating a culture of cooperation and you can support. As you discover a cut right out of one’s downline’ conversion process, so it now offers a robust incentive to coach and you may assist him or her.

The fresh older bonus, for this reason, contributes significant tax relief for those who fall under the brand new being qualified earnings brackets. Instantly earn added bonus opportunities when you shop to your names you love. Reputation on the personal tax and you can organization tax are some of the of many topics to the schedule in the AICPA & CIMA Federal Income tax Appointment, Nov. 17–18 inside Arizona, D.C., an internet-based These types of change result in the removal of the fresh terms FDII and GILTI, which can be renamed “foreign-derived deduction qualified money” and “net CFC examined income,” respectively. The fresh act as well as recommends switching the word deduction-eligible earnings to have reason for deciding FDII. The fresh implemented operate revises you to supply and you may food those write-offs as the allocable in order to “net CFC tested money” (that’s just what act transforms GILTI for the, find below).

Language from the Senate Financing Committee sort of the bill do provides addressed transmitted over too much company loss as the excessive team losses, which at the mercy of the new Sec. 461(l) limit, as opposed to as the online working losings (NOLs), that aren’t susceptible to Sec. 461(l). The new act would customize the definition of “automobile” to let attention on the floors package investment definitely trailers and you can campers becoming deductible. The fresh allowance are risen to one hundred% for possessions gotten and you may placed in services for the or just after Jan. 19, 2025, as well as given flowers grown otherwise grafted to the or just after Jan. 19, 2025. The new provision as well as creates a good Sec. 139K, and that excludes out of income scholarships and grants to your qualified second or primary knowledge expenditures out of qualified students. (Previous versions associated with the blog post misstated the financing amount and you will included information on a cap to the credit which was inside the a keen before sort of the balance but is beyond the last operate.)

—>Next 2026 Recognized Events- Click the link

In order to train the way the breakaway compensation package functions, let us think an easy example. The newest infinity incentive is actually paid off to your conversion volume of all the the new breakaway suppliers not in the given number of generations, to infinity. The newest generation bonus try paid off for the conversion process level of for each age bracket away from breakaway vendors, as much as a certain number of generations. The brand new breakaway compensation bundle has several features and you will variations that make it novel and you will challenging to know.

The project Breakaway Document: Employment Details

It might also provide altered the fresh dedication away from considered paid off borrowing from the bank to possess taxes safely attributable to checked income and alter the principles to have sourcing particular income on the sale away from list built in the us. Therefore, to possess purposes of the newest Sec. 163(j) attention deduction limitation for those decades, adjusted taxable money might possibly be calculated instead of mention of the brand new deduction to possess decline, amortization, or destruction. To own organizations, the ground would be step 1% of one’s corporation’s nonexempt money, plus the charity contribution deduction never exceed the modern ten%-of-taxable-income limitation. The new operate as well as allows income tax-exempt withdrawals from 529 deals plans to be studied for additional accredited advanced schooling expenditures, in addition to “qualified postsecondary credentialing expenses.” The credit speed levels off for taxpayers having modified revenues (AGI) over $15,000. Overtime write-offs manage simply be invited for certified overtime settlement in the event the the amount of certified overtime settlement is actually claimed separately to the Form W-dos (or Form 1099, if your personnel isn’t a member of staff).

Ruining Armor

But not, in the a change in the Senate Finance Committee’s kind of the balance, the brand new operate increases the phaseout of your own exclusion matter away from twenty-five% to help you fifty% of your amount whereby the fresh taxpayer’s alternative minimum taxable earnings is higher than the newest tolerance matter. The brand new act in addition to makes permanent the new $1,eight hundred refundable son income tax credit, modified to possess inflation. Which senior deduction starts to stage away when a great taxpayer’s MAGI is higher than $75,000 ($150,000 in the case of a joint come back).

Which creates a dynamic pressure ranging from supporting downline and you will promising these to crack away. The newest deeper the newest associates, the smaller the brand new override commission. As they reach specific conversion process plans or see specific requirements, they “crack away” from their upline (the one who recruited them) and get independent. Think of, there is absolutely no one-size-fits-all solution, and each team need to modify its settlement method to its book framework and staff. Such as, sales representatives you’ll focus only on the brief-identity development (age.grams., closure product sales easily) instead of nurturing a lot of time-label consumer dating. Balancing personal identification with team cohesion becomes difficult.